Performance Over Years

A Legacy of Growth and Excellence

Kanjirapally Service Co-Operative Bank has consistently demonstrated remarkable performance and growth since its inception. Our commitment to excellence, customer satisfaction, and community development has propelled us forward, making us a trusted financial institution in the region. Here, we take a closer look at our journey of performance over the years.

Steady Growth

Since our establishment, Kanjirapally Service Co-Operative Bank has witnessed steady and sustainable growth. Our financial strength is reflected in our expanding asset base, increasing deposits, and a robust loan portfolio. Year after year, we have maintained a strong balance sheet, ensuring stability and reliability for our customers.

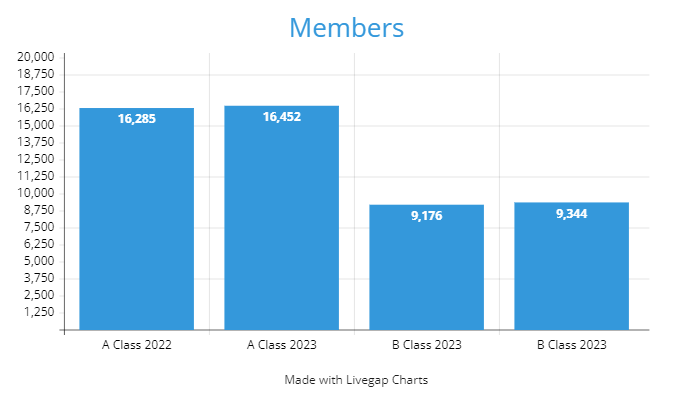

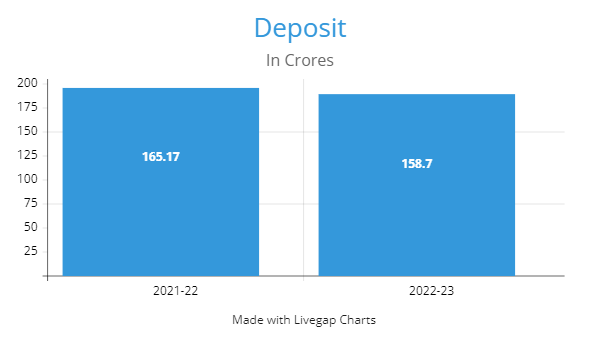

- Deposits: Our deposit base has shown consistent growth, reflecting the trust and confidence our customers place in us. We offer a variety of deposit schemes that cater to the diverse needs of our customers, encouraging savings and financial planning.

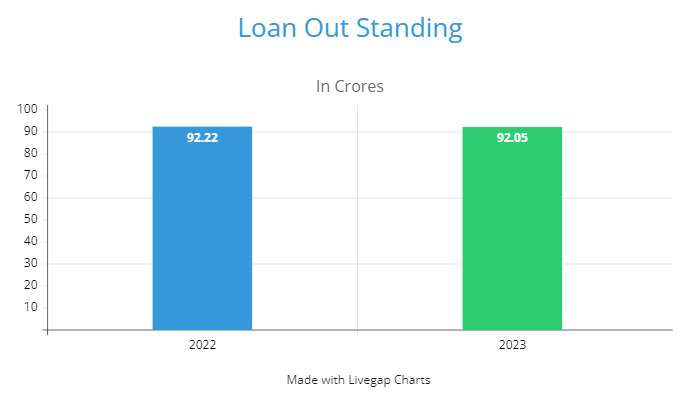

- Loans: Our loan portfolio has expanded significantly, supporting personal, business, and agricultural needs in the community. We offer competitive interest rates and flexible repayment options, making us a preferred choice for borrowers.

Financial Highlights

- Yearly Performance Indicators: Each year, we publish our financial performance indicators, showcasing key metrics such as total assets, net profit, and capital adequacy ratio. These indicators reflect our financial health and operational efficiency.

- Profitability: Our profitability has shown a positive trajectory, driven by prudent financial management and a focus on cost-efficiency. The surplus generated is reinvested into the bank, enabling us to enhance our services and infrastructure.

- Capital Adequacy: We maintain a strong capital adequacy ratio, ensuring that we have a solid financial buffer to meet any unforeseen challenges. This ratio is a testament to our sound financial practices and risk management strategies.

Technological Advancements

Embracing technology has been a key driver of our performance. Over the years, we have invested in modern banking technologies to enhance customer experience and operational efficiency.

- Digital Banking: Introduction of online and mobile banking services has made banking more convenient for our customers. Features such as fund transfers, account management, and loan applications are now just a click away.

- Automation: Automation of internal processes has improved our service delivery, reducing turnaround times and enhancing accuracy.

Customer Satisfaction

Customer satisfaction is at the core of our performance metrics. We regularly conduct surveys and feedback sessions to understand our customers' needs and expectations. The insights gained are used to improve our products and services continuously.

- Customer Retention: Our high customer retention rate is a reflection of the quality of service we provide. Many of our customers have been with us for generations, a testament to the trust and loyalty we have built.

- Service Excellence: Awards and recognitions received over the years for service excellence motivate us to continually raise the bar in customer service.

Community Impact

Our performance is not just measured in financial terms but also by the positive impact we have on our community. Through various initiatives and programs, we have contributed to the socio-economic development of Kanjirapally and surrounding areas.

- Financial Inclusion: By extending banking services to remote and underserved areas, we have played a pivotal role in promoting financial inclusion.

- Community Initiatives: Our involvement in community projects, educational programs, and healthcare services has made a significant difference in the lives of many.

Future Outlook

Looking ahead, we are focused on sustaining our growth momentum and enhancing our performance further. Our strategic plans include:

- Expanding Our Reach: Opening new branches and service points to bring banking closer to our customers.

- Innovative Products: Introducing new and innovative financial products tailored to the evolving needs of our customers.

- Sustainable Practices: Adopting sustainable banking practices to contribute to environmental conservation and social responsibility.

At Kanjirapally Service Co-Operative Bank, our performance over the years is a reflection of our unwavering commitment to excellence, innovation, and community service. We look forward to continuing this legacy and achieving greater milestones in the years to come.